Across the country, and certainly across California, lower Covid-19 new case counts combined with increasing vaccination rates and changing safety protocols have begun to shift the collective mindset towards life in a post-Covid world.

In May 2020, transaction volume in the housing market bottomed out as uncertainty around the future took its toll on nearly every industry. While so much has changed in the past year, many signs point toward a future market that is not unlike those of the past. Let’s take a look…

The velocity of money is rebounding and macro credit conditions remain strong.

Consumer spending is expanding after several quarters of pent up demand to purchase goods, while at the same time consumer default levels are declining and the stimulus wave has no end in sight.

Source: Source: US Federal Reserve

Household net worth is rising at the fastest pace since the 1950s, while the Fed continues to implement quantitative easing as part of stimulus efforts.

With so much money in the system combined with a low interest rate environment, hard assets like real estate represent the most attractive asset classes for those looking for long-term yield.

Source: Bloomberg

As mortgage rates ease from recent upticks, refinancing activity has fallen well below the mid-2020 frenzy.

Although the refinancing market has cooled, new mortgage originations are on pace for their best year ever, with 60% of new issuance from non-bank lenders.

Source: Mortgage Bankers Association Weekly Application Survey

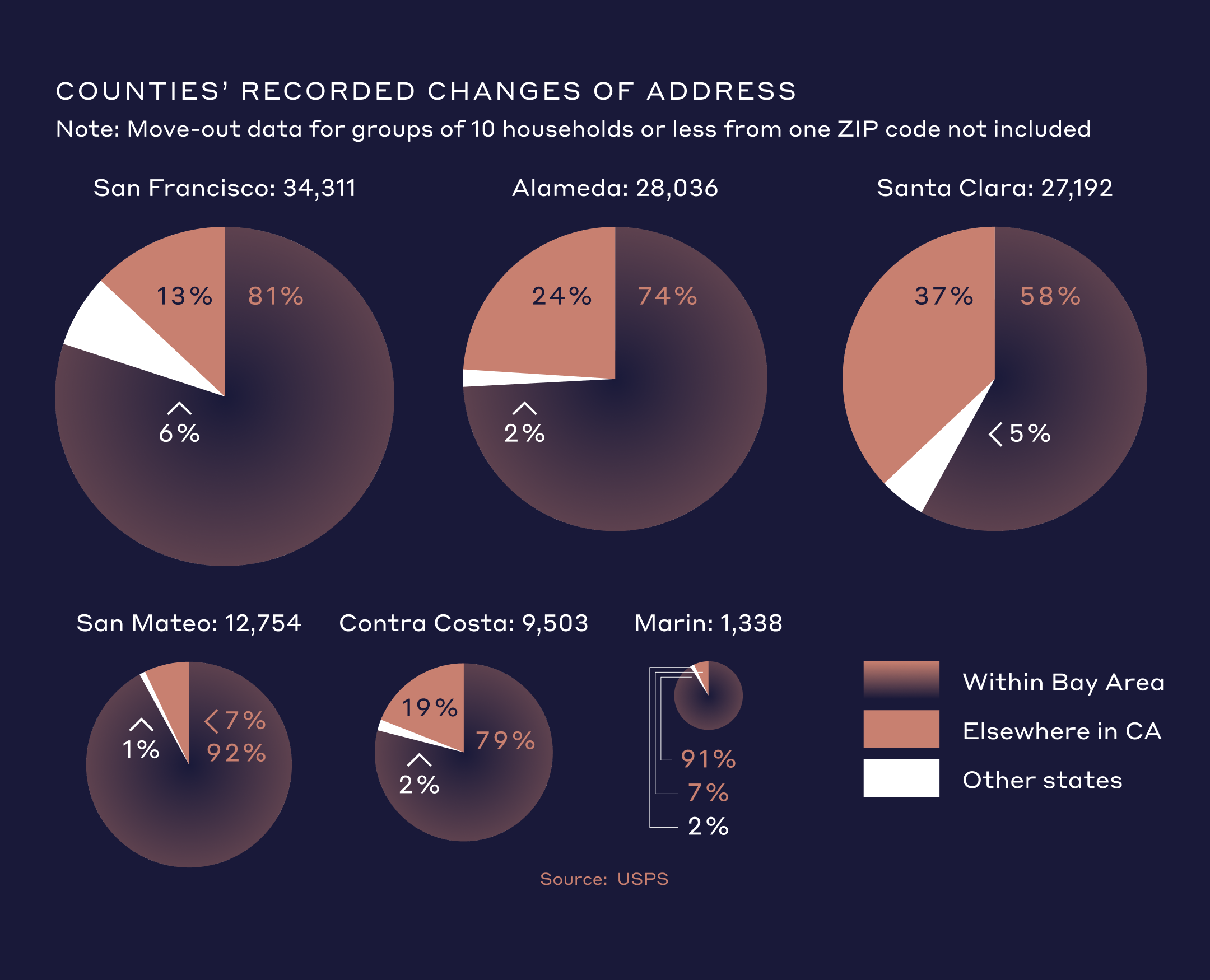

In Northern California, 97% of startups stayed in the Bay Area in 2020.

While Miami, Austin, and Denver have become emerging hubs for startup talent, the innovation ecosystem in the Bay Area continues to thrive - as does the housing market, with demand exceeding supply at unprecedented levels.

Source: Mortgage Bankers Association Weekly Application Survey

For those who did leave San Francisco, most stayed in the Bay Area and almost all stayed within California.

The migration patterns out of San Francisco have prompted first-time buyers in particular to seek more space in suburban markets that have experienced record price inflation as a result.

Source: USPS

Though inventory levels remain low in the Bay Area, with less than two months supply on the market, single family housing permits have been issued faster than forecast.

More supply coming to market may alleviate scarcity in the near future for SFH; on the other hand, multi-family permits are trending lower than forecast due to short-term reactions of high rental vacancies.

Source: Housing Tides

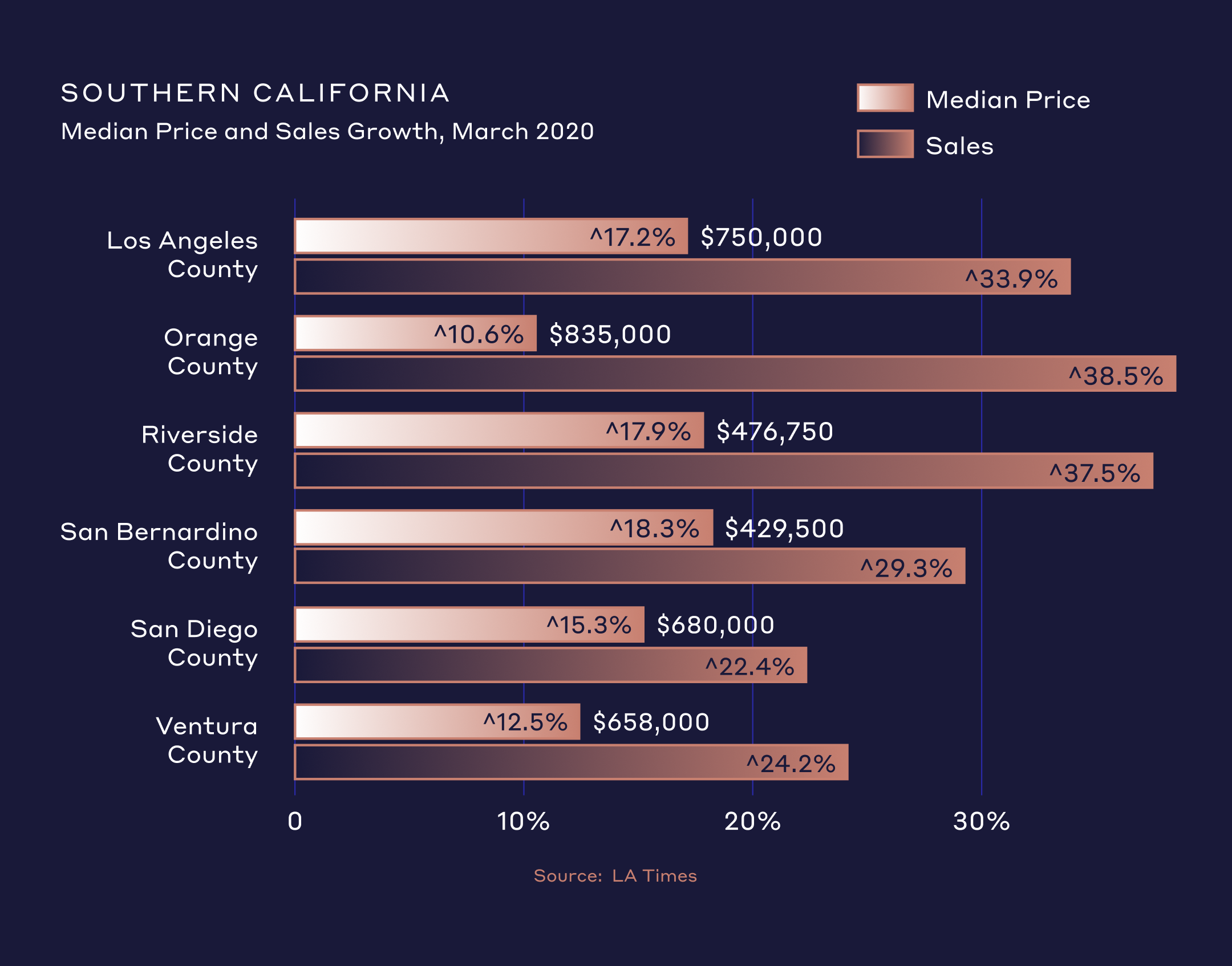

Nowhere is the buying frenzy more evident than in California, with Southern California experiencing eight consecutive months of double-digit price growth.

A mix of federal reserve policy and many first-time buyers entering the market has allowed monthly payments to remain relatively similar while properties are bid-up in competitive situations.

Source: LA Times

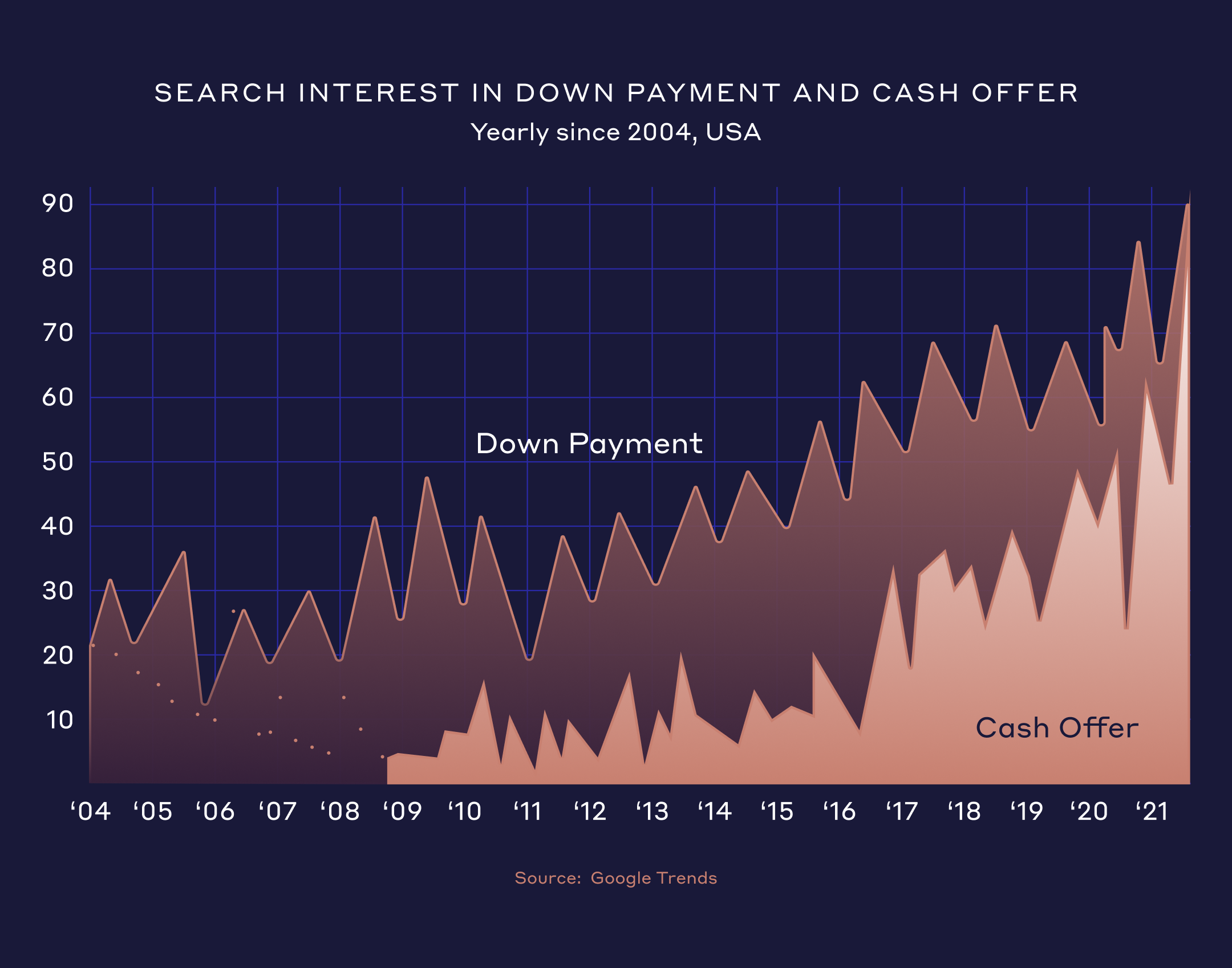

Will these market conditions continue?

Ask Google.

One thing is for sure - the past 12 months of shelter-in-place have generated an unprecedented focus on the home, and that trend appears to be accelerating.

Source: Google Trends

Will the market remain strong, or will levels begin to even out as rates rise into the summer months? Check out next month’s edition of The 8 to find out.

Join Our Newsletter

Latest Headlines